Five Things You Must Check Before Signing Terms And Conditions

Five Things You Must Check Before Signing Terms And Conditions

Five Things You Must Check Before Signing Terms And Conditions

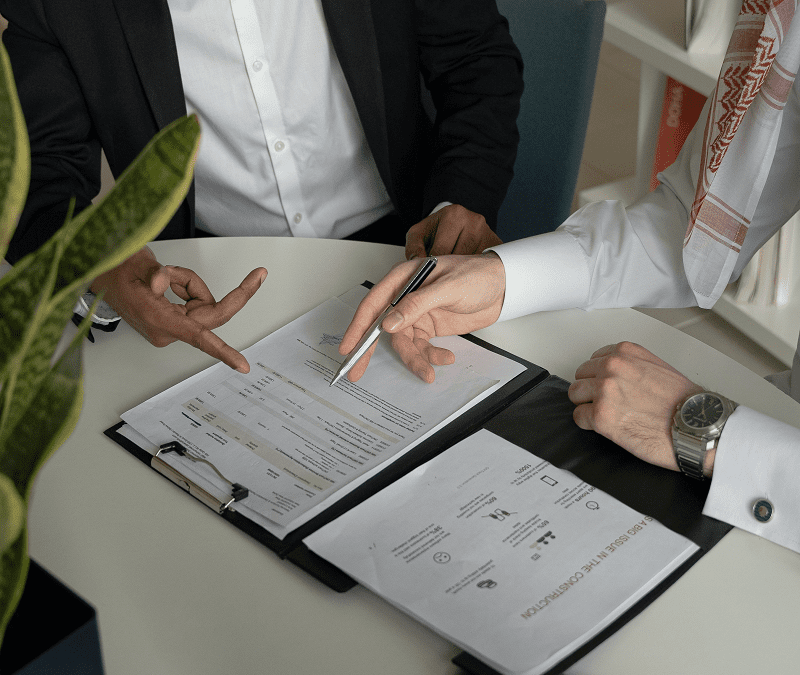

Let’s begin this article with some honesty – terms and conditions are distinctly unsexy. Consequently, many businesses make them a low priority, meaning sales teams are often merrily sending out quotations and onboarding new customers using outdated terms and conditions that no longer reflect the organisation’s needs. Even worse, operations staff will sign contracts with suppliers and customers despite never reading the latter’s terms and conditions. And often, things go well for months or even years until a costly, stressful dispute develops, draining you, dear business owner, of time, resources, and peace of mind. The worst thing is that many disputes are entirely avoidable.

To help you side-step common pitfalls that can waste tremendous amounts of money and time, we have put together five things you must consider before committing to a new supplier’s or customer’s Terms and conditions.

The payment terms

Many business owners have sometimes wondered if their company has suddenly morphed into a bank without them knowing. Late paying customers/clients play havoc with your cashflow. In some industries, especially manufacturing and construction, 90-day payment terms are standard. Read the terms and conditions payment terms before you send the first invoice so you can decide whether waiting 90 days or more for payment is something your cashflow can withstand.

Limitation of liability

The restriction of liability consistently stands out as a crucial concern in a sales contract for goods. Naturally, if you are the buyer, you will want to see as few liability limits as possible in the terms and conditions and, if feasible, enhance the supplier’s accountability in case of complications. On the other hand, a supplier will often fight tooth and nail to limit its liability within the contract to the greatest extent possible. One thing they cannot do, however, is subvert consumer protection legislation and (common law to some extent). Therefore, liability clauses in terms and conditions must be checked thoroughly to ensure you know exactly where the other party’s liability begins and ends.

Force majeure clauses

Before March 2020, few people had a clue what a force majeure clause was. Most of us now know, however, that such a clause in commercial contracts and terms and conditions suspends the performance of obligations if the party relying on the clause is hit by circumstances beyond their control. A supplier will want the force majeure clause to be as wide as legally possible, covering events such as war, terrorism, natural disasters, and, yes, perhaps pandemics.

When reviewing a force majeure clause, be aware that section 3 of the Unfair Contract Terms Act 1977 states that these clauses must be reasonable and events that prevent performance must be genuinely outside the supplier’s control.

Insurance

Never assume that a supplier’s insurance covers every eventuality. For example, a standard product liability policy is unlikely to extend to give products guarantee cover or protection against financial losses liability. It will usually only protect the supplier against liability for injury to third parties and damage to their property.

When the risk is transferred

Regarding B2C terms and conditions, the Consumer Rights Act 2015 states that any risk associated with goods passes to the consumer as soon as those goods come into the physical possession of either the consumer or a person identified by the consumer to accept them. Any attempt to make consumers liable for loss or damage of goods before this will likely be deemed unfair. However, a business can require a consumer to pay a reasonable charge for insurance and storage if they are tardy in collecting the items being delivered.

In B2B transactions, the Sales of Goods Act 1979 applies. Be aware that a seller will typically include details in their terms and conditions concerning when the risk is to pass from them to the purchaser, (for example, when the contract is made, or the goods are in a deliverable state), even if no payment has been made. If there are no terms to the contrary, section 20(1) of the Sale of Goods Act 1979 states that “goods remain at the seller’s risk until the property in them is transferred to the buyer, but when the property in them is transferred to the buyer, the goods are at the buyer’s risk whether delivery has been made or not.” If the delivery of the goods has been delayed, the party responsible for the delay carries the risk.

Wrapping up

If you take one thing away from this article, let it be this – reading and understanding the consequences of the other party’s terms and conditions can mean you avoid a costly and stressful dispute. If you doubt the impact of a particular term, get it checked by a Virtual In-House Legal Counsel. The cost of prevention will be minuscule compared with dealing with an avoidable quarrel.

To learn more about how our team can assist you, please email us at [email protected] or phone 0121 249 2400.

The content of this article is for general information only. It is not, and should not be taken as, legal advice. If you require any further information in relation to this article, please contact 43Legal.